take home pay calculator madison wi

After you request a waiver begin sending your payments by check immediately. The Savannah Ios 14 App Covers Ios 14 Icon Covers Etsy App Covers Iphone Minimal Iphone Design Include the employees full name and the payment key Read More Take Home Pay.

Wisconsin Paycheck Calculator Smartasset

Include on the check stub or memo.

. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. State employees are paid on the second thursday following a biweekly pay period. Wisconsin Salary Paycheck Calculator Change state Calculate your Wisconsin net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Wisconsin paycheck calculator.

This free easy to use payroll calculator will calculate your take home pay. The 2022 wage base is 147000. This is the 19th-highest cigarette tax in the country.

Supports hourly salary income and multiple pay frequencies. View future changes in the minimum wage in your location by visiting Minimum Wage Values in. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

For Medicare tax withhold 145 of each employees taxable wages until they have earned 200000 in a given calendar year. Also called manufactured homes mobile homes used as a dwelling receive a 35 sales tax exemption which means the remaining 65 is taxed at the full sales tax rate. Demands for a living wage that is fair to workers have resulted in numerous location-based changes to minimum wage levels.

The federal minimum wage is 725 per hour while Wisconsins state law sets the minimum wage rate at 725 per hour in 2022. Switch to Wisconsin salary calculator. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

Wisconsin Department of Revenue. You can choose between weekly bi-weekly semi-monthly monthly quarterly semi-annual and annual pay. Switch to hourly Salaried Employee.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Wisconsin. Wisconsin workers are subject to a progressive state income tax system with four tax brackets.

Use this calculator to help determine your net take-home pay from a company bonus. After a few seconds you will be provided with a full breakdown of the tax you are paying. You can alter the salary example to illustrate a different filing status or show an alternate tax year.

This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding. Living Wage Calculation for Madison WI. This Wisconsin hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Transportation expenses like bus fares and gas prices are 7. Todays mortgage rates in Wisconsin are 5281 for a 30-year fixed 4414 for a 15-year fixed and 3673 for a 5-year adjustable-rate mortgage ARM. State Date State Wisconsin.

Wisconsin Cigarette Tax. State Date State Wisconsin. The assumption is the sole provider is working full-time 2080 hours per year.

Overview of Wisconsin Taxes. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. The federal minimum wage is 725 per hour while Wisconsins state law sets the minimum wage rate at 725 per hour in 2022.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Wisconsin. The tool provides information for individuals and households with one or two working adults and. So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the Wisconsin Salary Calculator uses Wisconsin as default selecting an alternate state will use the tax tables from that state.

Most employers tax bonuses via the flat tax method where an automatic 25 tax is applied to your payment. If youre eligible for a 10000 bonus you might only come away with just over 6000 of. 485 x 00765 3710 so the.

The tax rates which range from 354 to 765 are dependent on income level and filing status. The assumption is the sole provider is working full-time 2080 hours per year. Free Online Paycheck Calculator for Calculating Net Take Home Pay.

Madison WI salaries are collected from government agencies and companies. Madison WI average salary is 73895 median salary is 69534 with a salary range from 25653 to 364000. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

The tax rates which range from 354 to 765 are dependent on income level and filing status. More information about the calculations performed is available on the about page. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Process and Data Services. Wisconsin Department of Revenue. Wisconsin Mobile Home Tax.

Employers must match this tax dollar-for-dollar. Note that bonuses that exceed 1 million are subject to an even higher rate of 396 Now 25 may not seem like all that much but if. To use our Wisconsin Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Bonuses are considered supplemental wages and as such are subject to a different method of taxation. View future changes in the minimum wage in your location by visiting Minimum Wage Values in Wisconsin. Make your check payable to.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. Demands for a living wage that is fair to workers have resulted in numerous location-based changes to minimum wage levels. Enter your salary or wages then choose the frequency at which you are paid.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Calculate your take home pay from hourly wage or salary. The tool provides information for individuals and households with one or two working adults and.

Paid by the hour. This 14000000 Salary Example for Wisconsin is based on a single filer with an annual salary of 14000000 filing their 2022 tax return in Wisconsin in 2022. Madisons housing expenses are 9 higher than the national average and the utility prices are 5 higher than the national average.

Living Wage Calculation for Wisconsin. For the Social Security tax withhold 62 of each employees taxable wages until they hit their wage base for the year. Switch to Wisconsin hourly calculator.

Switch to salary Hourly Employee. The most typical earning is 52000 usdall data are based on 292 salary surveys. Cigarettes are taxed at 252 per pack in Wisconsin.

Take Home Pay Calculator Madison Wi.

Neutral Shore Ios 14 Aesthetic Iphone App Icons 50 Pack Etsy App Icon Iphone Hacks Iphone Apps

Pin Van Michael Francis Op Diet Ideas Ketosis Diet Keto Diet Recipes Keto Supplements

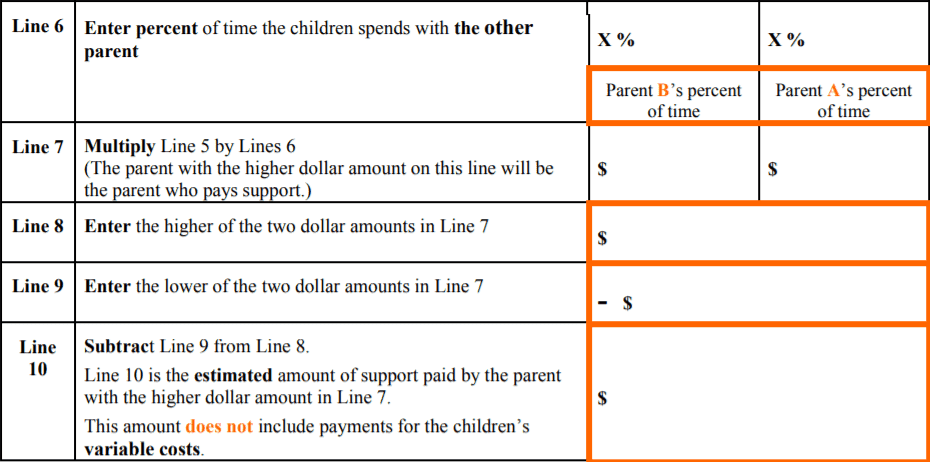

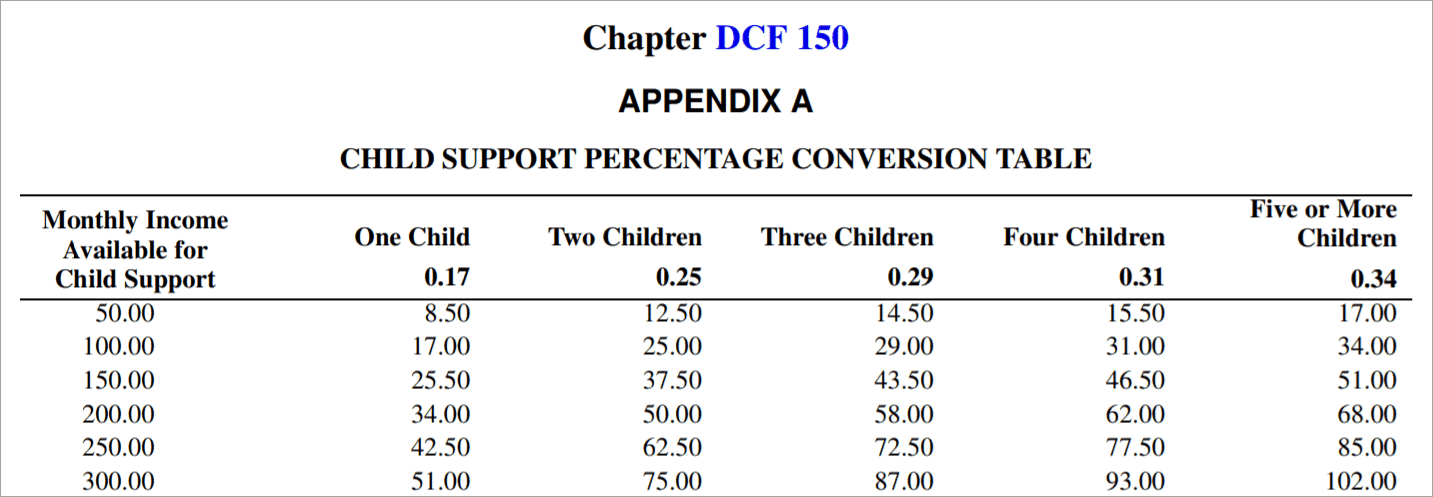

Calculating Child Support In Wisconsin

Wisconsin Income Tax Calculator Smartasset

Off Grid Solar System Sizing Calculator Unbound Solar Off Grid Solar Off The Grid Solar

Pin By Amani On B A D D I E S H I T I P S School Survival Kits Life Hacks For School High School Survival

The Easiest Wisconsin Child Support Calculator Instant Live

Wisconsin Paycheck Calculator Smartasset

Your Offer Office Of Student Financial Aid Uw Madison

Stay At Delton Oaks Resort In Wisconsin Dells Wi Dates Into October Kalahari Resorts Resorts In Wisconsin Kalahari Resort Wisconsin

There Are Many Homeowners Who Are Looking To Pay Off Their Homes Within 5 7 Year Replace Your Mortgage Debt F Home Equity Home Equity Line Line Of Credit

Wisconsin Income Tax Calculator Smartasset

Wisconsin Paycheck Calculator Adp

Wisconsin Paycheck Calculator Adp

Real Estate Kit Web Marketing Rosegold Macarons And Mimosas In 2020 Real Estate Agent Branding Web Marketing Real Estate Website

How To Calculate Adjusted Basis On Sale Of Rental Property Sapling Com Sapling Com Rental Property Daycare Buying Foreclosed Homes

The Easiest Wisconsin Child Support Calculator Instant Live

Family Vacations In Wisconsin Wisconsin Dells Vacation Locations Family Vacation